Our Products

Video Conference module with Emotion Quantification

Multiple applications of VC with emotion quantification are there including automated user onboarding, fraud analysis, and default prediction along them being the most significant applications.

Telemedicine Platform for Patient Triage and Treatment

Our telemedicine platform has multiple artificial intelligence feature which includes remote blood pressure measurement along with emotion quantification. Our telemedicine platform scalability ensures that we shall be able to treat a large number of patients across the globe seamlessly.

Remote Sensing for Maritime and Retail Industry Loans & Insurance

We are able to provide solutions for both maritime and terrestrial areas using artificial intelligence on large datasets. We also employ multi-platform multi-sensor data fusion by acquiring feeds from multiple satellites and then processing them in our proprietary data fusion engine for generating better insights.

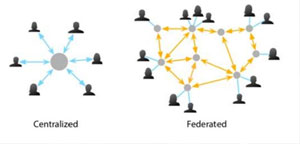

Healthcare Kiosk Federated Learning

We use multiple privacy ensuring mechanisms for protecting patient data including homomorphic encryption and quantum random number generator based one time pad/ quantum cryptography frameworks for complying with HIPPA standards including using HIPPA compliant AWS servers.

Hologram

We provide both hardware and software solutions for creating educational hologram systems which have become quite a hit in the post corona market place due to its ability to reduce contact and yet deliver content with a human touch including prayers by respected religious leaders.

Visa Automation GCC

In the GCC region, TB examination is mandatory for Visa application.

Making this region our primary market for TB screening automation using AI.

Emotion Quantification

A user’s previous emotional state can also affect the experience of subsequent emotions. Internal disturbances like processor speed, user’s lack of technical experience, system malfunction due to a computer virus, etc. External disturbances like the elements around the customer’s environment that will affect their emotional state, e.g. loud music playing. The goal of the emotion-oriented eCommerce system is to facilitate the switch from negative and unwanted emotions to a positive emotion which will be more receptive to purchasing a product or service.

Customer Segmentation

Our AI algorithms use some of the features in customer segmentation are Visitor Tiers – Logged In vs. Guest Users, VIP Status, Repeat Shoppers vs. First-Time Visitors; Users that have (or have not) completed an order in the last 30 days; Top Purchasers (High Cart Value), Location, Source type; From where they are searching the things maybe like Google vs Yahoo vs Bing vs Facebook vs LinkedIn; Device Types – Desktop, Mobile, Tablet – Using the metadata available from the electronic device, customer segmentation can be done; Personalized Data – Gender, Income, Style, Age etc; Site engagement duration or the number of times site visited, content (products) viewed, event or interaction, favourites &likes, Average Order Value, Account Type – Business account, Personal Account etc; Customer type – All Customers, Potential Customers, First-Time Buyers, Repeat Customer, Active Repeat Customers, At-Risk Repeat Customers, Inactive Repeat Customers.

Customer Value Prediction

The customer lifetime value (CLV) is an estimate of all the future profits to be accumulated from a relationship with a given customer. It is used in the business to measure the performance of retention strategies and to provide insights into how much should be spent in customer acquisition. CLV=Lifetime * Purchase Frequency * Average Order Value * Profit Margin. Lifetime relates to the expected duration a given customer will stay active on your platform. Churn rate, purchase rate and repeat rate helps in finding the same.

Customer Transaction Prediction

Accurately predicting the future behaviour/transaction of customer using predictive customer behaviour modelling techniques instead of just looking in the rear-view mirror of historical data. Predictive customer behaviour modelling would be possible with a combination of Customer Segmentation and Dynamic Segmentation.

Customer Satisfaction Index

We use machine learning to create recommendation engines and user interaction quantification models which when integrated with our emotion quantification algorithms gives us a real dynamic customer satisfaction index.

Our Own Credit Score Rating

We use deep learning models on top of data acquired from the prominent factors such as The credit scores are calculated based on some prominent factors such as Outstanding Balances, Credit Utilization, Total Experience, Payment Habits, Demographics, Public Record, Standard Industrial Classification Code, Business Size etc., and give our own credit score rating.

Ecommerce Fraud Analysis

We use AI-based approach for fraud analysis on the data collected on many factors such as First-time shoppers, Larger than average orders, Fast shipping, Unusual location, A large quantity of the same product, Multiple shipping addresses, Shipping/billing address doesn’t match IP address, Multiple cards from a single IP address, Odd use of punctuation or letter capitalization, Multiple transactions in a short time, Printful notifications etc.

Demand Forecasting

Demand forecasting is a process of predicting the demand for the product and services of an organization in the future to optimize supply or execute decisions. We use many methods like barometric method, Delphi method, conjoint analysis, predictive analysis, and so on which helps in demand forecasting.

Price Optimization

Price Optimization is the use of mathematical analysis by a company to determine how customers will respond to different prices for its products and services through different channels. It helps the company to meet its objectives such as maximizing operating profit. Price Optimization Models help businesses determine initial pricing, promotional pricing and discount pricing.

Churn Analysis

We use the methods like gathering available customer behaviour, transactions, demographics data and usage pattern; converting structured and unstructured data/information into meaningful insights; utilizing these insights to predict customers who are likely to churn; identifying the causes for churn and works to resolve those issues; engaging with customers to foster relationships, and implementing effective programs for customer retention

Upselling Algorithm

We use AI to do upselling which is a sales technique where you offer your customers the chance to purchase upgrades (better features, better specifications, more volume) or to get the more expensive version of what they’re buying so you can maximize the value of their purchase (higher price).

Geospatial Analysis

We use AI to do the geospatial analysis which will always give an edge towards eCommerce. The advantages are the ability to visualize spatial relationships like identifying the distribution of customers; Viewing purchasing behaviour; Understanding the demographic characteristics of local communities; Aids in customer relationship management (ERM); Aids in enterprise resource planning (ERP); Data Mining and Web-based address locator tools etc.,

Voice Based Shopping Assistant

We use AI to do voice command based shopping assistant which will be a massive shift for eCommerce market. Chatbot with a voice-based assistant will increase consumer engagement for shopping.

NLP Based Behavior Prediction

We can determine what customers are saying about a service or product by identifying and extracting information in sources like social media.The AI algorithms will do the sentiment analysis that can provide a lot of information about customers choices and their decision drivers.

MBTI Classification using Gamification

With the information collected from the customer segmentation and user profile of the customers, our AI algorithms can decide and predict whether a customer is outwardly focused / inwardly focused, how he/she takes in the given information, how to live his/her outer life and mainly how do he/she prefer to make decisions. Incorporating MBTI into eCommerce will effectively increase the customer satisfaction index and great product recommendations which are more likely to be bought by customers.

Sales Increase Via Hybrid Algorithms

Our module uses the algorithms like Apriori Algorithm; Hybrid Recommendation Engine; Content Based Recommendation Engine; Collaborative Filtering based Recommendation Engine; Image based Similarity Search using Convolution Neural Networks; MBTI Personality based Recommendation Engine to increase the sales.

Default Prediction Using Neural Networks

We use proprietary algorithms developed at Archeron to predict financial distress and potential default with 97.4% accuracy in large datasets. For which we were awarded by the central bank of India(RBI). Here, the baseline data is the fields collected about the person/organization who is the borrower. Using large training set data we are able to generate a model where the prediction coefficient is extremely high.

Fraud Analytics: Red Flag Detection and Fraud Prediction

We have developed fraud detection and fraud prediction algorithms using deep neural networks. We can predict with a high rate of accuracy in credit cards, bank loans, insurance payments, money transfer, and financial transactions. Our solutions are deployed across the spectrum in the BFSI ecosystem for combating money laundering and omnichannel fraud.

Facial Recognition and Emotion Quantification for Loan Decision

Today deep learning models can not only identify faces instantly but can also identify the expression of the user. The quantification of end-user emotions and automatic user/customer identification is going to revolutionize any industry which has a retail B2C aspect starting from hospitality to retail banking to name a few.

eKYC and Automation of Background Checks

We deploy custom scrappers and Spyders for acquiring data from open platforms and run various algorithms such as sentiment analysis on the scrapped data. We also acquire data with the users consent from various external sources such as credit rating agencies and national identity databases. Deep learning image algorithm is also used in conjuncture with a metadata scrapper for automated document verification along with standard OCR models.

Meta Data Extraction and Analysis for Verification & Profiling

Using our machine learning algorithms we are able to extract metadata from every digital file including text and image files and using another algorithm we analyze the extracted data and correlate it with the data provided by the user through other channels. We use metadata along with other AI algorithms like sentiment analysis for verification of documents to the profiling of users.

Loan Automation Process Using Machine Learning in Under 4 Minutes

Our loan automation process consists of the many steps like Spyder and scrapper-based data mining to enrich the profile of each potential loan seeker from open source; Classification of loan applicants into demographic and user buckets; Automated communication protocols; Filling up the loan form online and populating the form with biometric data, selfie based applicant image, and uploading documents which are verified by neural nets; Integration and population of the user profile with data from external sources like social media, search engines along with external databases like credit rating agencies and national identity databases; Loan decision engine where the prediction of default probability is carried out; If the default probability is low and document verification and identity verification has been completed then automatic disbursal of loans occur

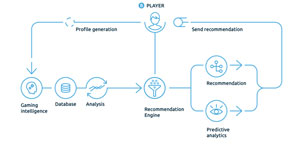

Recommendation Engine: Cross Sell Recommendation

Archeron’s Hybrid Reco Engine uses Collaborative filtering sometimes referred to as Social filtering at times because it considers the recommendations of other people. If a person has similar interests a second person then one can recommend the first person the items liked by the second person. If there are multiple people then the weighted average according to how similar the interests are can be used to recommend.

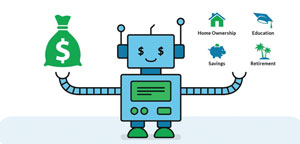

Intelligent Robo Advisor as Personalized Financial Advisor

Our intelligent Robo-advisors manage asset risk optimally and provide investment returns in line with industry averages. One of more preferred asset allocation avenues for Robo advisors is also exchange-traded funds which give consistent results. Based on the user profile such as age (for example above 50 years the Robo advisor will suggest pension plans) and other demographic and profile features the Robo advisor also recommends customized solutions and packages based on the risk appetite of that particular user type.

Islamic Finance Automation using AI Based Software Solutions

Machine learning today is reshaping the Islamic finance ecosystem by creating sharia-compliant algorithms and processes. These algorithms are used to automate and expedite the protocols of Madarabah; Musharaka; Murabahah; Ijara. Blockchain is used in conjuncture with machine learning to automate the Wadiah protocol. Due to the automated nature of the smart contracts based on which these protocols are implemented there is complete automatic compliance with the tenants of the Sharia law.

Financial Modules Integrated with Healthcare Ecosystem

We use AI and integrate the modules like ICD 10; Forex Remittance Platform; HL7 Integration; Blockchain-based payment platform; Payment Gateways; Smart Contracts; Health Insurance; Health Insurance – Hospital – Payee System integration for the healthcare ecosystem.

Artificial Intelligence Reshaping the Retail in Banking and Insurance

We today have developed the solutions for the retail space which are Chatbot based shopping assistant; Recommendation engine for not only selling similar items but also utilizing cross-sell opportunities; Emotion quantification of the shopper using facial expressions and blood pressure; Image-based search of similar merchandize; Customized product recommendation to shoppers based on their profile scraped from internet and other databases; Integration of automated loans for shopping via personal loan automation; Use of fraud analytics for online shopping portals; Use of credit card fraud detection algorithm; Sentiment analysis; Customer Satisfaction index and etc.

Dynamic Pricing: Economic Theory and Behavioral Economics

We use the following data feeds processed with the help of artificial intelligence to quantify customer satisfaction index such as Voice stress analysis; Voice transcribe and sentiment analysis on transcribed data; Facial emotions; Blood pressure (beta version). We also automatically conduct background checks on users using our scrappers and Spyders whose output datasets are analyzed by our algorithms. For high valued purchases, we also conduct a default probability calculation on the potential customer.

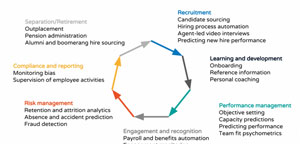

Human Resource Analytics Using Machine Learning

Our HR analytics suite of algorithms are used to solve the following issues such as Attrition rate analysis and prediction; Document verification for claims and other activities; Text analytics based supervision of employee activities for compliance purposes; Retention analysis; Fraud detection and prediction; Video analytics of emotion and blood pressure quantification during interviews; Metadata extractor for documents and profiling; Myers-Briggs type indicator for psychological profiling etc.

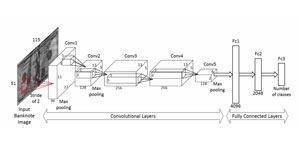

Image Analysis Using CNN for Document Verification

Automating the processes of image analysis is the key feature of the artificial intelligence field. The neural networks are the best tool to achieve a few of the most complicated problems. There are a lot of ALGORITHMS available in different languages to achieve the same. Tensorflow by Google in python. This is also one of the very useful neural network frameworks when where the processing is optimized by the framework itself. Caffe in a C++ based classifier that provides all the possible categories applicable to an image. Moreover, it also lists out the objects detected in a single image. All of these and a few more packages are tested to find an optimal solution for the problem at hand. The application of this does not limit to only document verification. It can be used in the medical field by identifying the problem areas from X-rays or other scans.

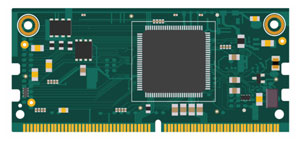

Intelligent Internet of Things: I – IoT

We have developed multiple solutions using IoT in a large number of industries which includes agriculture, automotive, and maritime. Our IoT solutions are also created to cater to other industries like manufacturing and logistics. Machine learning on chip and sensor output; Block chain integration with IoT for asset management; Realtime monitoring of manufacturing and supply chain assets; Remote operations; Intelligent machine learning based cloud based IoT platform; Automation of processes

Blockchain-Based Smart Contracts

At Archeron, we create our own blockchains from scratch and on top of our blockchain frameworks we generate our smart contract modalities. Smart contracts essentially remove the need for a third party in bilateral transactions. The biggest advantage of smart contracts and blockchains is that it has made trust redundant hence the use of intermediaries has been nullified in almost all business processes.

Real-Time Global Crude Monitoring Platform

Today this is possible due to the advances in the field of artificial intelligence especially image analysis and available global data on the surface of the planet on a daily basis. Such large workloads can only be analyzed using AI. Our solution is an amalgamation of both optical and synthetic aperture radar-based change detection. SAR can look through the dark and through clouds. Since oil and gas is a 24-hour cycle, we use an integration of both SAR and optical satellite imagery to reach a 24-hour coverage for more accurate analysis.

Archeron Machine Learning based Translation Engine

We employ machine learning algorithms along with natural language processing frameworks including entropy minimization maximization algorithms to translate various languages. The accuracy of the algorithm’s output is directly proportional to the richness and size of the training dataset. We are able to translate the following languages using our model such as Arabic; Chinese/Mandarin; Spanish and French.

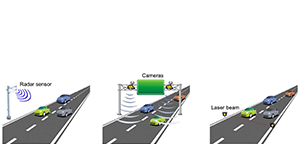

AI Applications for Toll Gates and Dynamic Financing Models

The type of analysis the camera are Car type / model identification; Car colour identification; Car number plate; Car timestamp; Facial recognition; Create UID for each face; Track last visit of same face (latitude-longitude of the last toll bridge) and match if with same car; Compare the face with facial recognition database; Run age, gender, and facial classes models; Identify the passenger faces also; FASTag payment and profile details which include bank wallet, car number and details, address; Dashboard and analysis; Have a real-time dashboard for accessing all the camera feeds analysis; Identify between owner and professional driver; Payment methodology identify i.e., cash or FASTag

Airport Solutions

We provide integrated solutions for the airport which includes solutions for increasing duty-free sales providing a secure shopping environment, cybersecurity using quantum solutions and emotion and demographic-based targeted sales.