AI Bank

We are building the World’s First Quantum AI Bank using Quantum technologies and Artificial Intelligence to be completely autonomous in its decision making. The larger parameters of the bank such as risk ratios and macroscopic directives will be set by the board on a quarterly basis which gets translated into algorithmic performance parameters and hence executed for the next quarter. The whole process right from client acquisition to customer onboarding to credit decision and loan disbursement is autonomous AI-driven without human interference.

The World’s First Quantum AI bank which uses Quantum Encryption, Quantum Cryptography, Quantum Communication, and Quantum Computing along with Quantum and classical machine learning for operating autonomously.

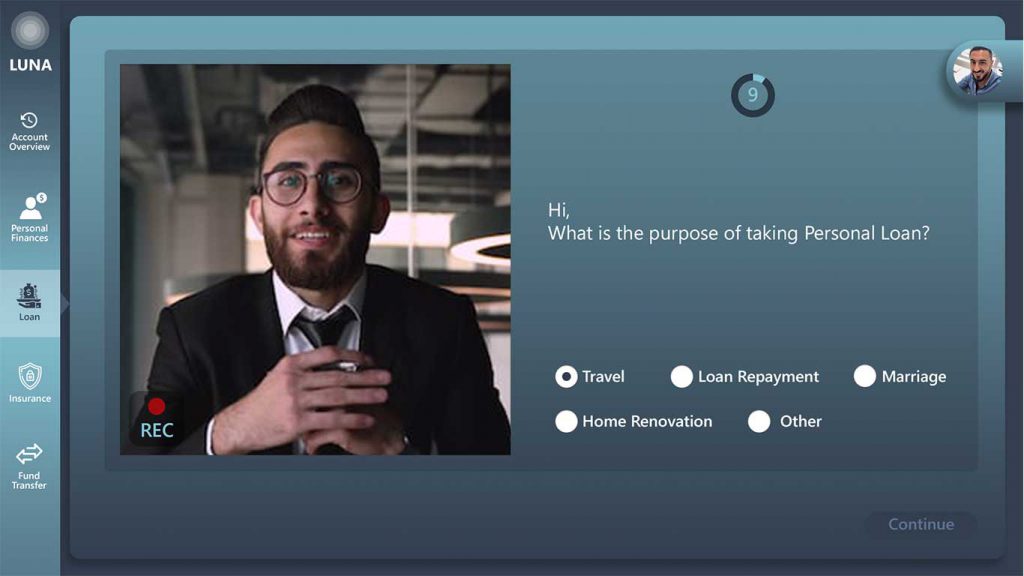

We provide a broad spectrum of loans right from personal loans to even agricultural loans.

The account summary is supplemented by AI-based recommendations on how to prudently utilize cash along with next month’s predicted cash outlays.

The bank also provides various other facilities like health insurance to be purchased autonomously in this platform. We provide the user an opportunity to autonomously and digitally purchase insurance like health insurance from one of our affiliate insurance providers.

The health insurance process includes uploading various health records to the platform which are automatically analyzed by the AI in the platform.

The health record helps the algorithm arrive at an accurate premium for the user.

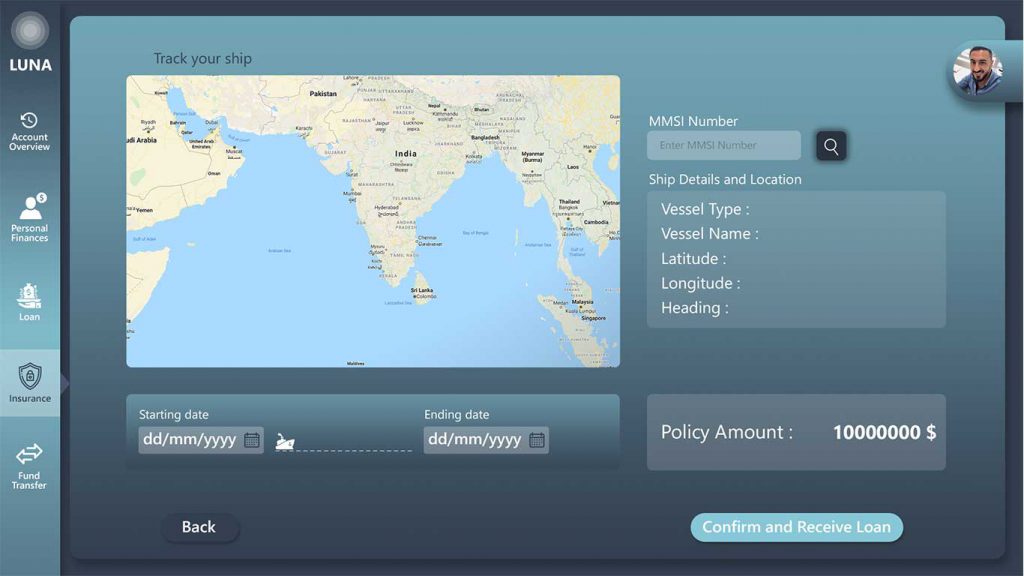

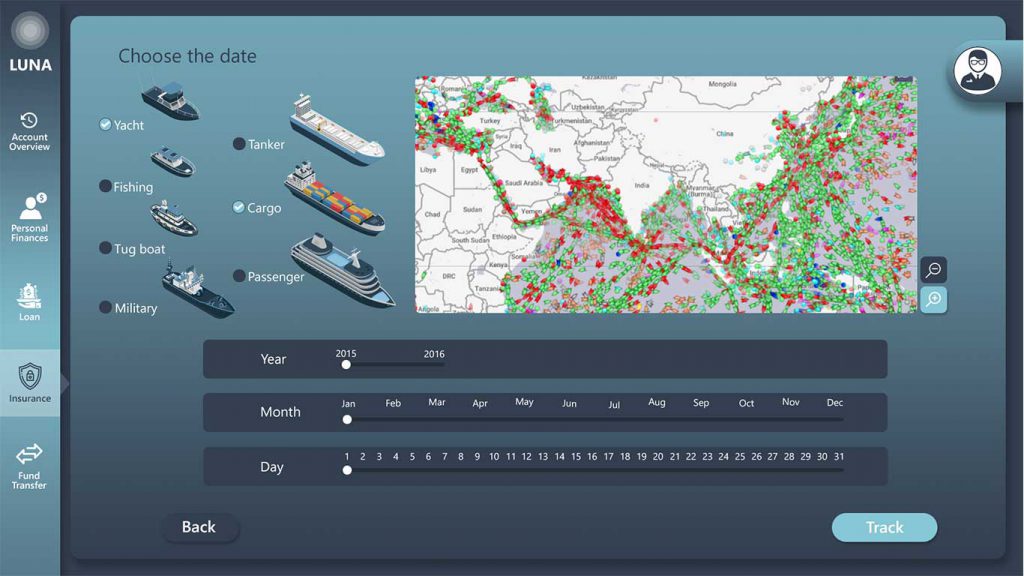

The other type of insurance we provide is dynamic maritime insurance where we are actively tracking the movement of ships using AIS and satellites for arriving at an accurate risk proportional insurance premium.

The video conference module which the user uses while onboarding or when he/she has issues that need clarification by either talking to our AI-driven banking assistant or to a banker at a central location has emotion quantification features in it like pulse, voice stress analysis, and facial expressions.

The ships are tracked using AIS and AI on both optical and synthetic aperture radar data.

The insurance premium is dynamically calculated based on that ship’s past performance and route analysis. For example, any ship passing through Somali Waters is automatically charged a higher premium due to piracy risks.

We use both supervised and unsupervised machine learning for fraud detection and prevention.